Shirley Wong, Director for Research at Colliers in Singapore provides insights into the Singapore developer market based on the data released by the Urban Redevelopment Authority (URA) on Friday, October 15, developer sales in September moderated further by 31.4% month-on-month (MOM) to 834 new private homes sold (excluding Executive Condos, or ECs) from August’s 1,216 units sold.

On a year-on-year (YOY) basis, developer sales declined 37.2% from the 1,329 units transacted in September 2020. This brings total developer sales (excluding ECs) year-to-date to 10,262 units – up 33.5% compared to the same period last year.

Developers sold 462 EC units in September, more than 4 times the 107 units sold in August. This was driven by robust demand on the new launch of an EC – Parc Greenwich. Overall, total developer sales (including ECs) in September 2021 amounted to 1,296 units, reflecting a decline of 2.0% MOM and 6.4% YOY.

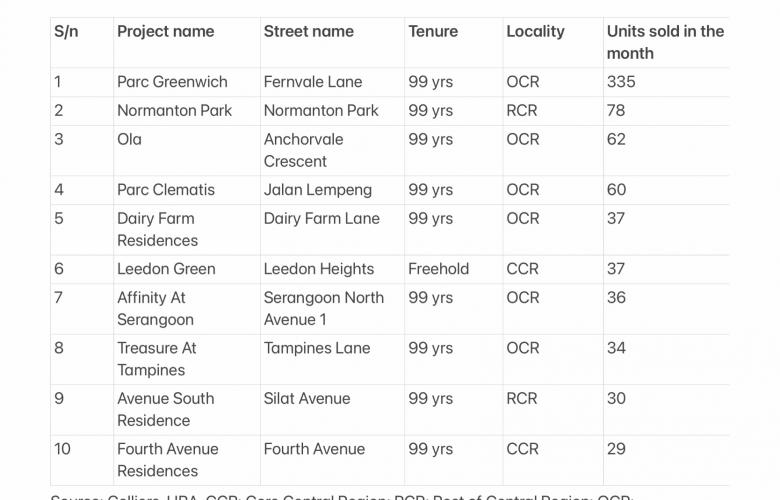

Top 10 Selling Projects in September 2021 (including ECs)

Shirley Wong, Director for Research at Colliers in Singapore, said “The best-selling private residential project in September was a new launch at Parc Greenwich, which sold 335 units, or 68% of its 496 units, launched at a median price of SGD1,229 per square foot. The majority of the units were sold during its launch weekend, which signals a strong demand.”

The other top-selling projects were mostly from the earlier launches, including Normanton Park, which sold another 78 units in September, at a median price of SGD1,832 per square foot. To date, the total number of units sold at Normanton Park was recorded at 1,249, or 67% of the total 1,862 units. Ola also continued to sell 62 units in the month, making the project 90% sold currently.

Analysis

The Outside Central Region, viewed as a proxy to the mass-market segment, made up 42.7% of total sales (excluding ECs) in September, compared to 59.3% in August. The relatively higher proportion of OCR sales compared to the other regions was driven by launch of Parc Greenwich.

Meanwhile, the Rest of Central Region or city fringe projects made up of 37.2% of total sales (excluding ECs), higher than August’s 28.5%, driven by the continued sales at Normanton Park. The Core Central Region, a proxy to the high-end segment, made up of 21.1% of total sales (excluding ECs) – an increase from the 12.5% seen in August.

Market activity continued to remain strong at the median price range of SGD1,500 to SGD1,999 per square foot, which contributed to 57.3% of total sales (excluding ECs) transacted in September 2021.

Outlook

Shirley Wong, Director for Research at Colliers in Singapore said, “We expect the overall housing market to remain positive, as the economy continues to recover. We believe that the momentum of residential sales is likely to pick up and remain strong in Q4 2021.”

Major projects in the supply pipeline include the 696-unit Canninghill Piers, 298-unit Liv @ MB, as well as the 230-unit Perfect Ten on Bukit Timah Road.

Despite potentially fewer new launches, we see stronger buying power potentially driving sales of the existing projects. As such, demand could overflow to the ongoing launches or the secondary market. We forecast that 2021 developer sales will reach 12,000 units, above the 10,000 units achieved in 2020.

With robust demand, sales and price index could also gain strength, although potential property cooling measures could temper the momentum should prices outpace the economic fundamentals. We expect private home prices to rise 6% in 2021, tracking GDP growth, said Ms Wong.

Further insights please contact Shirley Wong, Director for Research at Colliers in Singapore via the below contact details.